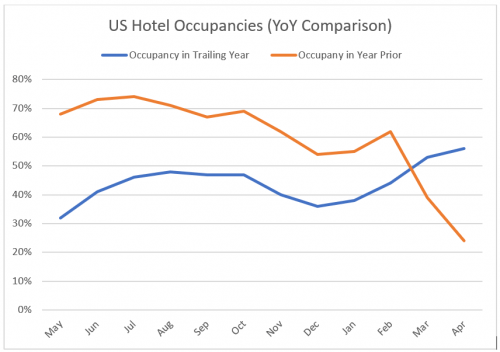

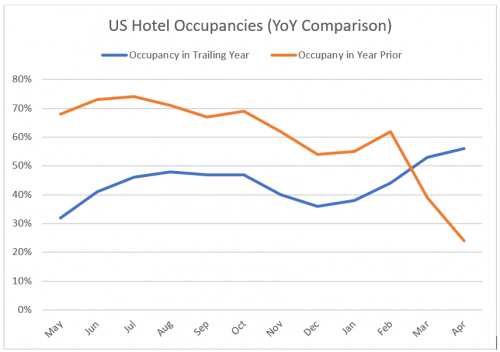

Operational performance of the hotel industry has all but halted as a result of the COVID-19 pandemic lockdowns. However, hotel real estate valuations remain high in response to pent capital earmarked for real estate acquisitions and hotels in particular. In January and February of 2020, hotel average occupancy in the United States was slightly higher than in recent years. However, occupancies began to plummet in March 2020 bottoming at 25% on average for April 2020 and 0% amongst those hotels which were simply closed. A slight uptick came in May and relative occupancy behavior returned but the seasonally informed annual curve had shifted down year-over-year. Hotels continue to operate a subpar performance while mimicking the relative peaks and troughs of the seasons (United Nations, 2021). A rational investor might think that this is the perfect opportunity to go bargain hunting. The problem is that a rational investor is not by any means alone.

Anecdotally, leisure travel has remained surprisingly resilient amidst the pandemic marginally limited by the scientific uncertainty around exposure to the virus and how it can be transmitted. TCI Research has been tracking consumer attitudes about travel through artificial intelligence that utilizes a method referred to as “social-listening”. TCI Research’s TRAVELSAT© Sentiment Index weighs the polarity of conversations on various internet threads and social media platforms to calculate a ratio of positive to negative original posts. The index has remained overwhelmingly positive over the past 18-month period excluding March 2020 and a moderate dip in January 2021, both of which correspond to the height of government-imposed lockdowns (TCI Research, 2021).

While internet conversations about travel are positive, internet searches for potential hotel bookings portray a slightly less optimistic view than consumer behavior in 2019. Over the first 12 months of the pandemic, those searches were down c.51% on average on a year-over-year basis. In April and March of 2021, however, those searches are up c.40% and a staggering c.246% year-over-year respectively (Sojern, 2021). It is important to note that the April and March 2021 calculations are made on a base of searches made during the beginning of the pandemic – a time when fear was arguably even more contagious than the virus.

Miami, a bit of an outlier, is perhaps a credible example of the positive travel sentiment and a possible indicator of the pent-up demand for leisure and entertainment. Second only to Tampa in February 2021, Miami was the only submarket to achieve an average revenue per available room (RevPAR) above $100 (hospitalitynet, 2021), likely because Tampa was hosting Superbowl LV that month. Largely, Florida has been a pioneer of sorts exploring the return to normalcy, having remained largely unrestricted for most of the pandemic. The relative success of the Miami hotel market gives some reason to believe that some portion of the subdued hotel demand is artificially restricted.

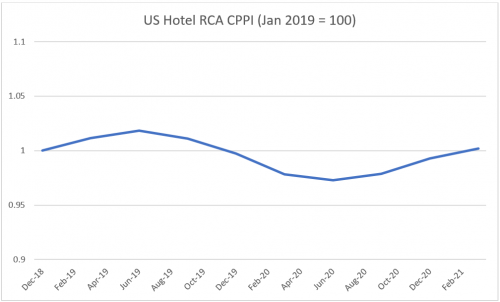

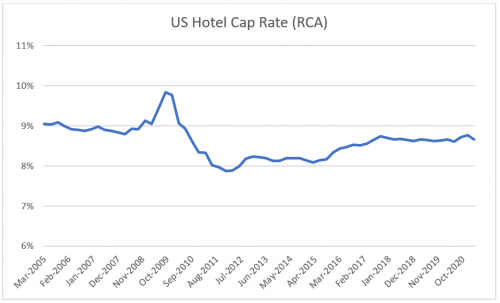

In the hotel industry, data about consumer and travel sentiments and booking translate into market assumptions that hotel operators and investors rely on to make strategic decisions. Most commonly, investment properties are valued just like any other asset, on their expected future cash flows. Typically, the income associated with a property relies on market assumptions which are incredibly difficult to make and even more difficult to defend, especially during a global pandemic. Most hotels’ RevPAR is still operating in recessionary territory (CoStar Realty Information, Inc., 2021). Naturally, the hotel valuations should decline proportionally, and cap rates remain in place. However, hotel valuations seem fairly stagnate. This may simply be due to a lack of market pricing as the total transaction volume of hotel properties in the United States has plummeted in 2020 to about a third of 2019 (JLL Hotels & Hospitality Research, Q1 2020).

The United States’ new hotel pipeline has contracted overall, decreasing by 12,000 rooms from December 2020 to March 2021 (JLL Hotels & Hospitality Research, Q1 2020). There were roughly 138,778 rooms in the pipeline in March 2020, so the decrease represents a c.8.7% contraction (Statista, 2021).

All forms of debt have been quite cheap in recent years with interest rates at all-time lows. Real estate acquisition and development loans have been no exception. However, since the onset of the pandemic, it has been increasingly difficult for hotel developers and acquirers to secure financing as lenders have trouble digesting the uncertainty of the recovery and reopening process.

From the equity side, public equities have swelled, but they are incredibly volatile, and private equity would like to speculate on hotel investments. The original narrative was that government lockdowns would shutter the hotel industry, which has happened in terms of operational performance. Private equity firms across the world have amassed record-breaking capital in 2020 to act on similar theses which have certainly contributed to the overvaluation of the few assets that have traded. In 2020, real estate investors raised about $26.3 billion to target hotel investment strategies representing a 43% increase from 2019. Most recently that pace has slowed as the anticipated high volume of transactions has not fully come to fruition. In the first quarter of 2021 fundraising for hotel investments dropped 59% year-over-year (JLL Hotels & Hospitality Research, Q1 2020).

Classical economics suggests that heavy government spending and the minting of new US dollars invariably lead to inflation. With the unprecedented fiscal stimulus created in response to alleviate to woes of the pandemic, the money supply has reached astounding levels (Federal Reserve Bank of St. Louis, 2021). Another traditional notion is that real estate tends to lag the broader market cycle (Mueller, 2019). While that has been true historically, the steadfast hotel valuations seen despite record vacancy rates could be interpreted as a precursor to general inflation. Perhaps in this unique case, the real assets have led the CPI which has just recently started to rise. Last month the Bureau of Labor Statistics measured a 2.6% increase in the CPI of “all items” (U.S. Bureau of Labor Statistics, 2021). It is possible that when everything else is in lockdown and consumer discretionary spending is in that way constricted, the investment market has become the foremost victim of inflation.

Real estate has traditionally been thought of as a go-to inflation hedge, citing that property valuations tend to rise consistently over the long term (The Conversation, 2021). The leases of some asset classes can be tied, either directly or indirectly, to the Consumer Price Index, as has been the case for many retail leases which are dwindling (MIT Economics, 2014). Cap rates are relative to and influenced by all other investment yields with the benchmark being treasuries and fixed-income investments. From the perspective of the diversified investor, potential allocations are determined indiscriminately and theoretically priced on their risk-reward profile. The recent observable behaviors indicate that the market has been turned on its head. Cap rates have not changed but the lack of occupancy means that the estimated net operating incomes are not collectible and have not been for over a year. With the amount of dry powder eager to snatch up hotels perhaps the hotel real estate market as a unified entity has been reset and repriced. If that is the case, the risk just does not buy what it did.

However, it is an interesting predicament, and it seems that not every market actor shares the sentiment. New hotel loans are few and far between because lenders, a relatively more conservative bunch, place heavier weight on the uncertainty of reopening in their market outlook. A market in which capital is not flowing or accessible is a characteristic of a liquidity crunch and usually correlates with an oncoming market correction. During the Global Financial Crisis, mortgage security positions were held at past valuations for just about as long as they possibly could be despite contradictory market signals indicating rapid devaluation. In fact, when Goldman Sachs started taking self-imposed write downs on the book values of the mortgage derivatives the banking community was very upset, knowing that they too would need to take write downs that would get larger and larger with every passing day (Cohan, 2011). Those actions set forth a serious and devastating wave that ultimately beached the market.

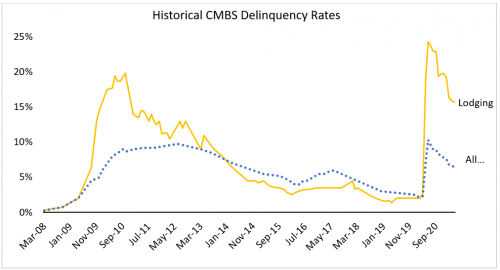

It is true that commercial mortgage delinquencies in the lodging sector spiked to levels even greater than the Great Financial Crisis. In March 2020, delinquencies of commercial mortgage-backed securities in the lodging sector reach nearly 25% versus the roughly 20% reached during the fall out of the Great Financial Crisis (Green Street Advisors, LLC, 2021). Most of those loans are still under forbearance despite a significant share of them being moved back into the “current” status. Those that are considered “current”, however, are over accounted for, when considering that many hotel borrowers have not written a true payment check since last February. Instead, they have been permitted to tap into their reserves and pandemic stimuli to remain afloat. That situation has delayed the necessity for a revaluation of these assets because owners have not been forced to deal with distress. Trepp CMBS research suggest that pandemic protections will become less rigid and opportunistic investors may yet see distressed investing opportunities on the horizon.

The current economic environment seems to have vailed the creditability of the hotel investments. Investors and potential seller are not wrong to base their valuations on the hopeful indications of consumer demand. In fact, when the times are unprecedented, historical data points become irrelevant and the hotel industry has moved into more of a growth business from that perspective. Speculating on the future, therefore, can be the only basis for underwriting. The irony is that a growth market investing strategy should demand a higher yield which would be represented in the form of cap rate expansion. Since potential EBITDA is limited due to operational challenges, cap rates would have to expand by virtue of falling values. The hotel market is currently in an artificial state. A reopening theme should curb the realizable distress as borrowers fall out of pandemic protection but certainly a correction is in order.

References:

Cohan, W. D. (2011). Money and Power, How Goldman Sachs Came to Rule the World. New York: Anchor Books.

CoStar Realty Information, Inc. (2021, March 11). STR: U.S. hotel results for week ending 6 March. Retrieved from str.com: https://str.com/press-release/str-us-hotel-results-week-ending-6-march

Federal Reserve Bank of St. Louis. (2021, May 25). Real M2 Money Stock [M2REAL]. Retrieved from FRED Economic Data: https://fred.stlouisfed.org/series/M2REAL, May 25, 2021

Green Street Advisors, LLC. (2021, May 7). CMBS Distress Metrics Diverge. Commercial Mortgage Alert, pp. 7-8.

hospitalitynet. (2021, March 22). STR: US Hotel Performance Improves In February. Retrieved from hospitalitynet.org: https://www.hospitalitynet.org/news/4103566.html

JLL Hotels & Hospitality Research. (Q1 2020). Global Hotel Market Update and Investment Trends. JLL Research.

MIT Economics. (2014). Has Real Estate been a good Hedge against Inflation? Will it be in the future? Retrieved from economics.mit.edu: https://economics.mit.edu/files/14673

Mueller, G. R. (2019). Real Estate Market Cycle Monitor. Denver: University of Denver – Burns School of Real Estate & Construction Management.

Sojern. (2021, May 25). UNWTO Tourism Recovery Tracker. Retrieved from UNWTO.org: https://www.unwto.org/unwto-tourism-recovery-tracker

Statista. (2021). Number of hotel rooms in the construction pipeline worldwide as of March 2021, by company. S. Lock.

TCI Research. (2021, May 25). UNWTO Toursim Recovery Tracker. Retrieved from UNWTO.org: https://www.unwto.org/unwto-tourism-recovery-tracker

The Conversation. (2021, March 24). As inflation looms, here’s how real estate and farmland have protected investors. Retrieved from theconversation.com: https://theconversation.com/as-inflation-looms-heres-how-real-estate-and-farmland-have-protected-investors-155854

U.S. Bureau of Labor Statistics. (2021, May 25). CPI Database. Retrieved from bls.gov: https://www.bls.gov/cpi/data.htm

United Nations. (2021, May 25). UNWTO Tourism Recovery Tracker. Retrieved from UNWTO.org: https://www.unwto.org/unwto-tourism-recovery-tracker

https://blog.realestate.cornell.edu/2021/05/25/the-state-of-hotel-investments-in-early-2021/